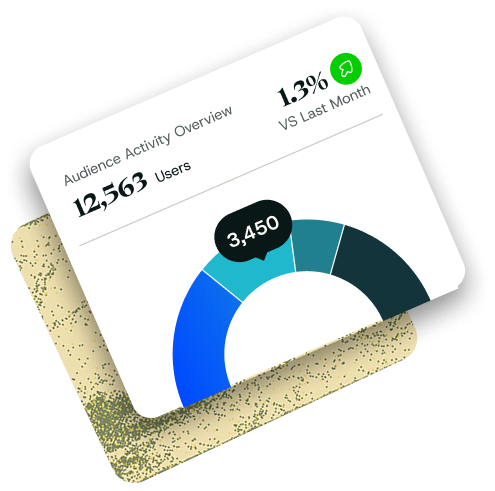

Describe population-representative data across multiple emotional dimensions, across the complete customer journey

Enlight's population-representative data reveals how trust, anxiety, and confidence shape interactions with banks, fintechs, and insurers; helps financial institutions understand the real insights driving loyalty. Capture consumer emotion from first inquiry to long-term engagement. Track emotions from awareness through onboarding, usage, and loyalty. Reduce drop-offs through friction detection and optimize digital experiences to build confidence at every stage. Identify trust barriers in digital banking adoption that prevent customers from fully engaging with new services.

Diagnose the complex reasons behind consumer reactions

Go beyond surveys and service metrics. Decode the emotional and contextual triggers behind hesitation, disengagement, or brand preference. Understand why customers adopt, delay, or abandon financial products. Build trust with informed communication that addresses specific concerns and improves product adoption rates by removing emotional barriers especially during stressful periods.

Predict hidden trends before they become negative hypes

Detect early emotional signals of trust erosion, digital fatigue, or shifting needs. Predict churn before it happens and identify customer groups that are at risk of switching providers. Predict which customers need proactive outreach and strengthen customer lifetime value through targeted retention strategies based on emotional state analysis. Act before small frustrations become lost relationships.

Prescribe action recommendations that tell you what to do next

Get guidance on how to improve experiences at high-friction moments and design touchpoints that build confidence rather than create doubt. Guide teams on when and how to communicate to maximize trust and minimize possible anxiety.

Explore more solutions by industry